KUALA LUMPUR: ACE Market firm Bioalpha Holdings Bhd, which is targeting a Main Board listing, is counting on its exclusive tie-up with national cooperative organisation Angkasa to propel its domestic earnings in the coming years alongside the positive breakthroughs that it has made in overseas markets.

Reflecting its outsized ambitions for a small cap company, Bioalpha has already established a diverse set of businesses in the span of two years since its 2015 listing. Among others, the company co-manages the Constant chain of pharmacies, distributes its own brand of healthcare products, and cultivates its own plants for extraction purposes.

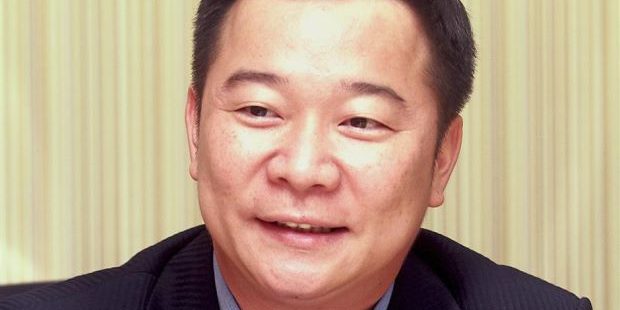

In an interview, Bioalpha’s managing director William Hon Tian Kok highlighted its business partnership with Angkasa as a fruitful and highly rewarding. The Angkasa counts a whopping 12,000 co-operatives as members with a total client base of eight million. The biggest co-operatives under this umbrella include the Royal Malaysia Police co-operative, Koperasi Permodalan Felda (KPF), and Koperasi Petronas (Kopetro).

“Our focus is on Constant. We aim to have 30 outlets by year-end from 15 currently and the greater number of outlets will bring better turnover. The next opening will be in Kota Bharu and Desa Jerteh in Terengganu,” he said.

The company has moved away from the saturated Klang Valley pharmacy chain market and into other states. The concentration of civil servants and enforcement officers in areas outside Klang Valley is among the prime targets for Bioalpha’s businesses thanks to the access provided by Angkasa.

Bioalpha and Angkasa’s 70:30 joint venture company, Alphacare Sdn Bhd, is involved in the management of Constant Pharmacies. The cost of opening the outlets is borne by franchisees while Alphacare charges a fixed management fee from each outlet’s gross income.

“This joint venture gives us access to Angkasa members all over the country. We have already rolled out a loyalty programme to recruit them as our pharmacy members,” he said.

The members are eligible to purchase the products either at a special price or through a financing scheme arranged by some of the co-operatives which is paid for via monthly wage deductions, Hon explained.

This seems to have played a part in spurring the group’s domestic sales. Inclusive of the earnings of its pharmacy operations, Bioalpha’s domestic revenue base grew by 250% to RM21.21mil in its financial year ended Dec 31, 2016 (FY16) from just RM6.26mil a year ago.

Its latest venture is the creation of a franchise business via a virtual pharmacy called e-Constant which will also be managed by Alphacare. It lets customers purchase Bioalpha’s products online and register as referral agents, through which they will be rewarded with cash points for each successful referral sale. The points can then be used for their next purchase of products.

In a recent note, CIMB Research cited the arrangement as a win-win deal for Bioalpha and Angkasa. Co-operative members are able to build individual businesses via referrals, while at the same time Bioalpha gets to boost its pharmaceutical and home brand sales, it said. The research house, which currently has not imputed the potential earnings from e-Constant, has a target price of 37 sen for Bioalpha’s shares.

The company can count on a solid revenue mix to insulate it from potential downturns in the domestic market. Overseas earnings currently contribute about 45% to the group’s revenue base. Hon expects the revenue mix to be closer to 50:50 by year-end.

While the “China angle” is an often-cited catalyst among small cap firms in Bursa Malaysia, Bioalpha has distinguished itself with real and tangible earnings contribution from the world’s most populous nation. In fact, revenue from China now accounts for nearly a third of the company’s revenue base as at FY16.

“Our customers in China re-sell our products the conventional way, that it through outlets and online marketplaces. If you browse through listing on Chinese sites like Tmall and Taobao, you will see a lot of Malaysian healthcare products for sale. It is a big growth market,” he said,

Elsewhere, the group currently sells seven products in Indonesia and hopes to get another six approved by regulators by this year. By having its own factory in Pekan, Riau province, Bioalpha is able to expedite the approval process for its products compared to importing it from Malaysia, Hon said.

It may come as a surprise that the company’s shares have actually underperformed the broader market’s recent advance. Despite its 30% advance year to date, the stock is is down slightly on a year-on-year basis. In comparison, the FBM KLCI Small Cap Index has advanced % to date.

There is also the matter of the group’s high earnings multiple which may put off some investors. It currently carries a price earnings ratio of 20 times according to Bloomberg data, though the figure could also represent investors’ enthusiam over its consistently high profit margins.

Bioalpha reported a RM8.83mil net profit on the back of RM47.72mil in revenue for FY 16.

Hon said that the firm’s bid for a Main Market listing will eventually open up its equity base to a new pool of investors who are more focused on the company’s fundamental growth as opposed to short term fluctuations in the market.

“We aim to make an application to be transferred (to the Main Board) once we meet all the requirements. We hope to make the announcement soon in the next few months,” he said.

Read more at http://www.thestar.com.my/business/business-news/2017/04/17/tieup-with-angkasa-to-boost-bioalphas-domestic-earnings/#gAx6ITICqKo6uHyy.99