9 February 2024,

THE nation’s largest optical retail chain Focus Point Holdings Bhd is strategically positioned to capitalise on the steady consumption growth of consumers who are increasingly conscious of eye health and prefer eyewear that caters to practical and aesthetic needs.

Hence, the counter has been tagged a ‘Buy’ by RHB Research in an initiation report released last week, with a 52-week target price of RM1.02.

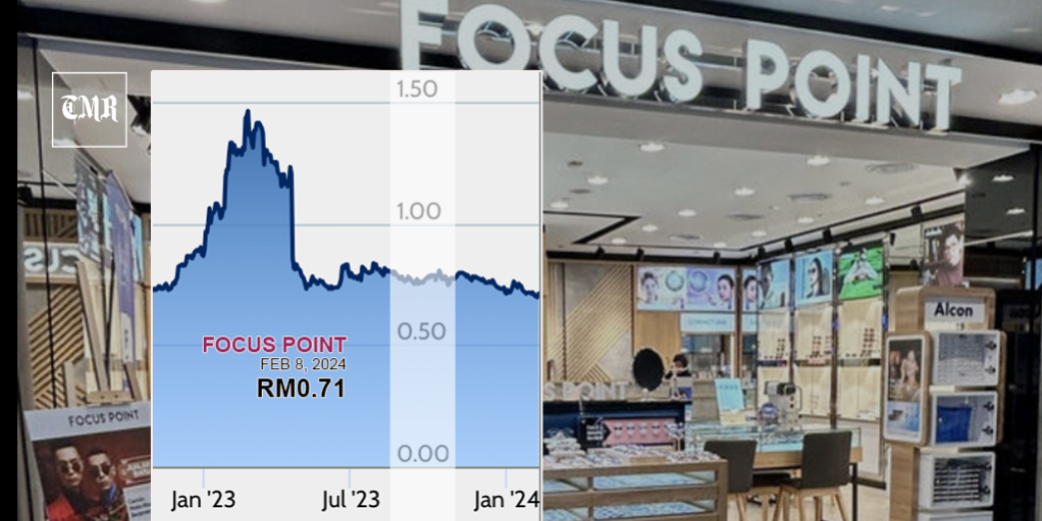

The counter closed at 71 sen on Feb 8, up from 69.5 sen a day earlier, which happened to be its 52-week low. Its 52-week high was RM1.06.

The company, valued at around RM326 million, commands a market leading position with a store network of 189 outlets as of 3Q23 and various store formats to cater to consumers of different income groups.

“We foresee a more stable earnings outlook for the F&B unit after the accumulation of valuable experience over years and with sound expansion plans in place,” according to RHB Research.

It noted that the counter was trading below at a 50% discount to peer average, adding that the current valuation has yet to price in Focus Point’s ‘solid business fundamentals, exciting growth prospects, superior profitability, and ROE’.

The report noted that Malaysia’s eyewear market was expected to record an accelerating 5-year compound annual growth rate (CAGR) (2024- 28F) of 6.6%, on the back of increased screen time leading to vision issues and a growing population with presbyopia due to an aging population.

Moving forward, it said the group was planning to open 20 outlets, inclusive of 10 franchised stores, in FY24, which would support its forecasted 12% and 11% growth in segmental revenue and pre-tax profit.

For the first nine months through September 2023, Focus Point posted a net profit of RM19.7 million, down 5.7% from the same period a year earlier, on the back of RM187.2 million in revenue, up 6.8% from the year before.

Focus Point has three streams of revenue: Retailing optical and related products, franchise management of franchised professional eye care centres; and food and beverage.

After chalking up a 9M23 segmental pre-tax loss of RM1.2 million, RHB Research said it believed an earnings turnaround was imminent as the main drag in having excess workers was fully resolved in September 2023.

“Venturing into the F&B business in 2012, management has accumulated valuable experience and expertise in managing both the F&B retail and central kitchen operations.

“As such, we look forward to more stable earnings. Plans for this segment include the expansion of the Komugi bakery outlets (3-4 outlets targeted for FY24F) and to secure more corporate customers to fill up the capacity of its central kitchen (current utilisation rate: 70%). On top of that, it is also looking to launch a frozen yogurt brand in view of the growing demand and lucrative profitability,” it said.

The company is spearheaded by Datuk Liaw Choon Liang who is its president/CEO. His spouse Goh Poi Eong is the company’s executive director. – TMR

Source: The Malaysian Reserve

Full Article: https://themalaysianreserve.com/2024/02/09/focus-point-to-capitalise-on-rising-myopic-population/